The Walt Disney Company (DIS) is perhaps now best known for its top of the line media brands like ESPN, Marvel and Pixar. However, the classic animated fairytale stories that Mr. Walt Disney himself created are an important part of the company's history. Now it looks like these animated characters could be a part of Disney's future and investors should probably take notice.

Click here to read and enjoy!

Phil

Saturday, December 28, 2013

Wednesday, December 25, 2013

Is Chipotle The Next Yum! Brands?

Even on Christmas day I am blogging! Hope everyone is enjoying the day so far.

A stock that I am growing increasingly bullish on, which is the reason I have been adding to my position significantly in recent months, is Chipotle Mexican Grill (CMG). Chipotle is known for its burritos and unique approach to fast causal dining. The company basically reinvented the segment as has been a leader in it ever since.

However, Chipotle is now branching out into other food-themes. The much talked about ShopHouse concept is the company's take on Southeast Asian cuisine and the only-recently announced Pizzeria Locale is the company's take on custom pizza. Chipotle's brands are now reminiscent of those at Yum! Brands (YUM), the company behind restaurant chains like Taco Bell and Pizza Hut. The diversity reduces risk and enhances growth potential for Chipotle going forward. As such, it is one of my largest positions and I expect it to outperform significantly in 2014 and beyond!

Click here to read and enjoy my latest article on Chipotle! Merry Christmas and happy holidays to all,

Phil

A stock that I am growing increasingly bullish on, which is the reason I have been adding to my position significantly in recent months, is Chipotle Mexican Grill (CMG). Chipotle is known for its burritos and unique approach to fast causal dining. The company basically reinvented the segment as has been a leader in it ever since.

However, Chipotle is now branching out into other food-themes. The much talked about ShopHouse concept is the company's take on Southeast Asian cuisine and the only-recently announced Pizzeria Locale is the company's take on custom pizza. Chipotle's brands are now reminiscent of those at Yum! Brands (YUM), the company behind restaurant chains like Taco Bell and Pizza Hut. The diversity reduces risk and enhances growth potential for Chipotle going forward. As such, it is one of my largest positions and I expect it to outperform significantly in 2014 and beyond!

Click here to read and enjoy my latest article on Chipotle! Merry Christmas and happy holidays to all,

Phil

Tuesday, December 24, 2013

Merry Christmas and Happy Holidays To All

Just in time for Christmas, I published three new articles for The Motley Fool today! Here they are:

For Target, A Breach Of Trust Is The Main Concern

The big news leading up to the holidays was the massive data breach at the third-largest retailer in The United States, Target (TGT). The company exposed over 40 million consumers' sensitive credit/debit card data and is already embroiled in a number of lawsuits and investigations.

However, the main concern for Target going forward has to be the potential loss of valuable customers. After all, while Target has a great brand, it also must compete with the likes of Costco (COST) and industry titan Wal-Mart (WMT).

Click here to read why Target may not be such a great buy even after the stocks recent drop!

Phil

However, the main concern for Target going forward has to be the potential loss of valuable customers. After all, while Target has a great brand, it also must compete with the likes of Costco (COST) and industry titan Wal-Mart (WMT).

Click here to read why Target may not be such a great buy even after the stocks recent drop!

Phil

Nike Continues To Excel On The Global Stage

Most investors who follow me probably know that I am a big fan of Under Armour (UA), both the company and the stock. However, this doesn't mean that I do not like Nike (NKE). The company is after all the undisputed king of athletic footwear in the world. With a solid earnings report behind it and powerful momentum in key businesses like North America and China, shares of Nike look set to continue sprinting ahead in 2014. Click here to read more!

Phil

Phil

Noodles Is Worth A Second Look

With shares of Noodles & Company (NDLS) steadily approaching their post IPO close price, the time seems right to reconsider the company as a long-term investment. With solid management and a unique spin on fast casual dining, Noodles may be set for a major turnaround in 2014. Click here to read more!

Phil

Phil

Monday, December 23, 2013

Balchem Just Got Even Better

In my latest article for The Motley Fool, I go back to an old favorite of mine, Balchem (BCPC), the small-cap designer and manufacturer of chemicals used in the animal supplement, medical and oil & gas industries. The company recently announced two new bits of information that remain critical for investors and only serve to make one of the greatest growth stocks even better!

Click here to read and enjoy!

Phil

Click here to read and enjoy!

Phil

Sunday, December 22, 2013

Lululemon's Real Problem Is That It's Still A Yoga Company

In my latest article for The Motley Fool, I discuss one of my favorite group of companies, the retail apparel makers. Lululemon (LULU), Nike (NKE) and Under Armour (UA) all have very popular brands with loyal consumer bases. Not surprisingly, the three stocks have all been media darlings in recent years.

However, Lululemon has a crucial problem, it is still only a yoga company. Whereas Nike and Under Armour have both greatly diversified their business mix away from their original core audience, Lululemon is stuck selling primarily to women and unable to branch out effectively.

Additionally, Nike, Under Armour and even The Gap (GPS) are starting to market specifically towards yoga consumers and beginning to eat into Lululemon's core market share. When added with a management team that seems incapable of stemming the tide, Lululemon appears headed for a drastic slowdown in growth, which is directly reflected in the company's recently lowered guidance and plunging share price.

Click here to read more about why Lululemon is in trouble and the course I think it has to take to remain on a path towards growth. Enjoy!

Phil

However, Lululemon has a crucial problem, it is still only a yoga company. Whereas Nike and Under Armour have both greatly diversified their business mix away from their original core audience, Lululemon is stuck selling primarily to women and unable to branch out effectively.

Additionally, Nike, Under Armour and even The Gap (GPS) are starting to market specifically towards yoga consumers and beginning to eat into Lululemon's core market share. When added with a management team that seems incapable of stemming the tide, Lululemon appears headed for a drastic slowdown in growth, which is directly reflected in the company's recently lowered guidance and plunging share price.

Click here to read more about why Lululemon is in trouble and the course I think it has to take to remain on a path towards growth. Enjoy!

Phil

Wednesday, December 18, 2013

Why A Discovery Buyout Of Scripps Makes Sense

The idea that Discovery Communications (DISCA) was interested in buying Scripps Networks Interactive (SNI) made the rounds last week when Variety reported that such a discussion was mentioned in the former's most recent board meeting. Although it would be difficult to finalize, the potential deal would make for one of the most powerful media companies in terms of pure content creation.

Click here to read my take on the possibility and ramifications of such a deal.

Phil

Click here to read my take on the possibility and ramifications of such a deal.

Phil

Monday, December 16, 2013

Disney's Media Library Just Got Even Better

The Walt Disney Company (DIS) made headlines last week when it announced that it struck a deal with Paramount Pictures to acquire the marketing and distribution rights for all future films in the Indiana Jones franchise. The move is not totally unexpected as Disney had already acquired production rights for all future films in the popular franchise with its 2012 acquisition of Lucasfilm.

However, the deal does make it possible for Disney to now build the Indiana Jones franchise in any way it wants. It now seems increasingly likely that the titular adventure hero will be joining his space-faring Star Wars friends in Disney's growing media library in the near future.

Click here to read how I think Disney will proceed with Indiana Jones in the years to come!

Phil

However, the deal does make it possible for Disney to now build the Indiana Jones franchise in any way it wants. It now seems increasingly likely that the titular adventure hero will be joining his space-faring Star Wars friends in Disney's growing media library in the near future.

Click here to read how I think Disney will proceed with Indiana Jones in the years to come!

Phil

Saturday, December 14, 2013

The True Power Of The Food Network

Since I have written about Scripps Networks Interactive (SNI) a lot recently, with yet another article currently in the works, I thought it would be interesting to delve into what exactly makes the company's networks so popular and effective. The reason lies in the company's viewer base, which is affluent, loyal and exactly what advertisers want to see.

Click here to read more about the true power of networks like Food Network!

Phil

Click here to read more about the true power of networks like Food Network!

Phil

Potential Winners And Losers In The Online Gambling War

Many people across the country are excited for the legalization of online gambling. So far, only Nevada and New Jersey have made the controversial decision to allow gamblers to bet online. However, the majority consensus seems to be that it is only a matter of time before more states legalize online gambling. The benefit of increased tax revenue is simply too large for state legislatures to ignore for long.

The potential widespread legalization of online gambling is equally exciting for investors. Many of the major American casino operators are attempting to get in on the ground floor while others are still hesitant and more cautious regarding the new venture.

Will Caesars Entertainment (CZR) and MGM Resorts International (MGM) be able to capitalize on their early and aggressive moves in the space? Will waiting too long hurt larger casinos like Wynn Resorts (WYNN) and Las Vegas Sands (LVS)?

Click here to read my take on which companies stand to benefit the most in the impending online gambling war!

Phil

The potential widespread legalization of online gambling is equally exciting for investors. Many of the major American casino operators are attempting to get in on the ground floor while others are still hesitant and more cautious regarding the new venture.

Will Caesars Entertainment (CZR) and MGM Resorts International (MGM) be able to capitalize on their early and aggressive moves in the space? Will waiting too long hurt larger casinos like Wynn Resorts (WYNN) and Las Vegas Sands (LVS)?

Click here to read my take on which companies stand to benefit the most in the impending online gambling war!

Phil

Here's Why W.W. Grainger Is Great

In my latest article for The Motley Fool, I analyze an old favorite company of mine, W.W. Grainger, a distributor of facilities maintenance, repair and operating supplies. The company has long excelled at growing both revenue and earnings as well as dividends and the powerful trend shows no signs of stopping anytime soon.

Click here to read why Grainger continues to be a great investment!

Phil

Click here to read why Grainger continues to be a great investment!

Phil

Thursday, December 12, 2013

MasterCard, Visa, Or American Express: Which Stock Belongs In Your Portfolio?

I am a big proponent of the trend towards a cashless society and I feel investors stand to benefit immensely if they ride the momentous wave for the next few years. Three of the best positioned companies to capitalize on this consumer trend are MasterCard (MA), Visa (V), and American Express (AXP).

However, MasterCard recently demonstrated why it is the best investment out of the three. Company management announced this week that it was raising MasterCard's dividend by a staggering 83% and implementing another $3.5 billion share buyback. Additionally, the stock will be split for the first time 10-1.

Click here to read how this trio of data points will benefit investors going forward!

Phil

However, MasterCard recently demonstrated why it is the best investment out of the three. Company management announced this week that it was raising MasterCard's dividend by a staggering 83% and implementing another $3.5 billion share buyback. Additionally, the stock will be split for the first time 10-1.

Click here to read how this trio of data points will benefit investors going forward!

Phil

Tuesday, December 10, 2013

Discovery & Scripps: Content Creation At Its Finest

Anyone who has followed my articles is no doubt familiar with my affinity for media companies that primarily engage in content creation. In a world where technology advances so rapidly and viewers can watch their favorite movies and television shows whenever and wherever they choose to, the only aspect that will remain the same is the demand for new and compelling content.

In this regard, there are few companies that perform as well as Discovery Communications (DISCA) and Scripps Networks Interactive (SNI). Both companies have the unique ability to create new and popular content rather easily and effectively. Furthermore, it is content that is simply not available from many other competitors and as such captures a loyal and dedicated viewer base.

Click here to read more about two of the best media companies with regard to content creation!

Phil

In this regard, there are few companies that perform as well as Discovery Communications (DISCA) and Scripps Networks Interactive (SNI). Both companies have the unique ability to create new and popular content rather easily and effectively. Furthermore, it is content that is simply not available from many other competitors and as such captures a loyal and dedicated viewer base.

Click here to read more about two of the best media companies with regard to content creation!

Phil

King Of The Casinos!

In my latest article for The Motley Fool, which will be followed up shortly by another piece next week, I focus on the lucrative 'Resorts & Casinos' industry. After a relatively quiet year in 2012, almost all of the casino stocks have roared back to life in 2013. Las Vegas Sands (LVS), MGM Resorts (MGM) and Wynn Resorts (WYNN) are all up more than 50% year-to-date.

The question now is, which casino stock is set to lead the industry higher in 2014? Click here to find out which gaming company I like best for next year, enjoy!

Phil

The question now is, which casino stock is set to lead the industry higher in 2014? Click here to find out which gaming company I like best for next year, enjoy!

Phil

Which Is The Healthiest Grocer Of Them All?

When it comes to food, it pays to eat healthy. However, the same could also be said about your portfolio! Considering the robust revenue and earnings per share growth of natural grocers like The Fresh Market (TFM) and Whole Foods Market (WFM), it has certainly paid to invest in healthy alternatives over the years!

Click here to read and find out which natural grocer belongs in your portfolio going forward!

Phil

Click here to read and find out which natural grocer belongs in your portfolio going forward!

Phil

Sunday, December 8, 2013

Two Small Alternatives To Johnson & Johnson

Investors looking to benefit from the success of popular brands in the 'Consumer Goods' space may want to consider smaller alternatives to conglomerates like Johnson & Johnson (JNJ). Two prime examples are Church & Dwight (CHD) and Prestige Brands Holdings (PBH).

Click here to read my latest article for The Motley Fool and learn why bigger is not always better!

Phil

Click here to read my latest article for The Motley Fool and learn why bigger is not always better!

Phil

Saturday, December 7, 2013

Great Things Come In Small Packages

The obvious is almost always overlooked. This popular phrase rings true with regard to investing as much as it does about life in general! One overlooked company is in the 'Packaging and Containers' industry, the appropriately named Packaging Corporation of America (PKG).

Although its primary business of producing corrugated container board products and related shipping services may be slightly boring, Packaging Corp's growth is anything but. The company's recent acquisition of smaller rival Boise has significantly bolstered Packaging Corp's industry positioning by greatly enhancing production capacity. Packaging Corp is now the fourth largest producer of container board in The United States and is set to grow revenue over 60% and EPS over 35% in fiscal 2014.

Click here to read more about the overachieving PKG, enjoy!

Phil

Although its primary business of producing corrugated container board products and related shipping services may be slightly boring, Packaging Corp's growth is anything but. The company's recent acquisition of smaller rival Boise has significantly bolstered Packaging Corp's industry positioning by greatly enhancing production capacity. Packaging Corp is now the fourth largest producer of container board in The United States and is set to grow revenue over 60% and EPS over 35% in fiscal 2014.

Click here to read more about the overachieving PKG, enjoy!

Phil

The Future Dividend Greats

When I think of the greatest dividend stocks, I think of companies that have sizable yields but also grow dividends at consistent and robust rates. Very few companies do this but some that do include VF Corporation (VFC) and W.W. Grainger (GWW).

However, just as important as identifying the current dividend greats is identifying the potential greats. Companies like MasterCard (MA), Starbucks (SBUX) and Visa (V) fall into this second category because their respective management teams have shown a willingness to increase payouts at rapid rates in their relatively short dividend history.

Not only are these three companies growing revenue and earnings per share very fast, they are now on watch for entry into the prestigious dividend great category. Click here to read more about the future dividend greats!

Phil

However, just as important as identifying the current dividend greats is identifying the potential greats. Companies like MasterCard (MA), Starbucks (SBUX) and Visa (V) fall into this second category because their respective management teams have shown a willingness to increase payouts at rapid rates in their relatively short dividend history.

Not only are these three companies growing revenue and earnings per share very fast, they are now on watch for entry into the prestigious dividend great category. Click here to read more about the future dividend greats!

Phil

Forget Coach, Buy Michael Kors For The Holidays

With some analysts predicting a weak 2013 holiday shopping season, only the strong brands will survive. Perhaps no brand is hotter than Michael Kors (KORS) is right now. The company has extreme pricing power, which is evident in robust and increasing margins, and is rapidly expanding its stored count across the world.

Click here to read more about KORS and enjoy!

Phil

Click here to read more about KORS and enjoy!

Phil

Tuesday, December 3, 2013

Ford Is Making Tesla Look Good

On a day when shares of Tesla (TSLA) are rallying over 10%, investors may be kicking themselves for not buying on the recent correction. Much of the stock's weakness has stemmed from the very public fires on Model S cars that occurred in recent months.

However, Tesla isn't the only one encountering problems with major vehicle releases, Ford (F) is too! The industry stalwart's woes illustrate perfectly that the automative world is a complicated beast and that investors may have overreacted to Tesla's problems.

In my latest article for The Motley Fool, I explain why I think all long-term growth investors should consider Tesla now.

Phil

However, Tesla isn't the only one encountering problems with major vehicle releases, Ford (F) is too! The industry stalwart's woes illustrate perfectly that the automative world is a complicated beast and that investors may have overreacted to Tesla's problems.

In my latest article for The Motley Fool, I explain why I think all long-term growth investors should consider Tesla now.

Phil

Monday, December 2, 2013

Does It Pay To Be Nice In Business?

The answer is usually no, sadly. However, for Alaska Air Group (ALK), it most certainly does! The small flight company stands out for its commitment to consumers in an industry known for notoriously bad customer service. This dedication to passengers has made Alaska Air Group's signature flight brands top choices among travelers and has cemented the company's positioning in crucial markets like the last frontier.

Click here to read more and enjoy!

Phil

Click here to read more and enjoy!

Phil

The Dividend Difference!

Sunday, December 1, 2013

American Express: A Cheaper Alternative To MasterCard and Visa

Since the rise of two of the fastest growing payment leaders, MasterCard (MA) and Visa (V) has been well documented by me in recent months, I thought I would focus on a cheaper but equally solid company in the space, American Express (AXP).

While not growing revenue and EPS as fast as its two largest competitors, the credit card giant has a stronger clientele and stands to benefit from many of the same powerful trends as MasterCard and Visa. Additionally, the company is significantly cheaper and pays a solid dividend. Click here to read more about what I think makes American Express great!

Phil

While not growing revenue and EPS as fast as its two largest competitors, the credit card giant has a stronger clientele and stands to benefit from many of the same powerful trends as MasterCard and Visa. Additionally, the company is significantly cheaper and pays a solid dividend. Click here to read more about what I think makes American Express great!

Phil

What's Next For AMC Networks?

Can AMC become the next HBO? That is the big question, as management at AMC Networks (AMCX) seems intent on following the massive success Time Warner (TWX) has achieved with blockbuster drama on its premier cable network, HBO.

However, with several of AMC Networks' shows reaching maturation, what else can the company do to sustain growth? Click here to read and find out!

Phil

Saturday, November 30, 2013

A Hidden Gem In The Chemicals Space

Small-cap companies like Stepan (SCL) are often overlooked by the majority of investors because they operate in typically conservative industries like specialty chemicals. However, this in no way means they are not capable of extreme outperformance. In fact, Stepan has been one of the best performers in the chemicals space in recent years and the company's growth is only improving! Click here to read more about this hidden gem. Enjoy!

Phil

Just Do It! Buy Nike

In my latest article for The Motley Fool, I write about one of the best stocks in history, Nike (NKE). Even though the athletic footwear/apparel/accessories company has already been one of the biggest success stories in America, Nike is still growing at robust levels and remains one of the best and most consistent growth stories in the world. Click here to read and enjoy!

Phil

Phil

Wednesday, November 27, 2013

Amazon's Plan To Take Over The World Is Almost Complete

What Is Driving VF Corporation's Growth?

In my latest article for The Motley Fool, I write about the main drivers of growth behind VF Corporation's (VFC) increasingly solid 2013 performance. As one of the most recognized retailers in the world, VF Corporation is still in the early stages of an aggressive 5-year global expansion. The company also remains one of the most consistent dividend growth achievers in the market. Click here to read and enjoy!

Phil

Phil

Sunday, November 24, 2013

FleetCor: A Fleeting Growth Opportunity

Anyone who reads my articles on a regular basis knows that one of my favorite industries is 'payments solutions.' In addition to being financially sound, companies that engage in the processing of payments like MasterCard (MA) and Visa (V) are currently riding a tremendous wave of growth across the world.

An alternative play in the space is FleetCor (FLT), a leading payment provider to fleet operators. The company's more niche business, which focuses on businesses and government entities, is growing rapidly and shows no signs of stopping anytime soon. Click here to read and find out more!

Phil

An alternative play in the space is FleetCor (FLT), a leading payment provider to fleet operators. The company's more niche business, which focuses on businesses and government entities, is growing rapidly and shows no signs of stopping anytime soon. Click here to read and find out more!

Phil

Disney Vs. Time Warner: Clash Of The Superheroes

With all of the superhero-related movies hitting theaters in recent years, it is a perfect time for investors to consider which company behind the blockbuster releases makes for the better investment, The Walt Disney Company (DIS) or Time Warner (TWX).

Both companies have formidable superhero offerings but which one is right for investors? Click here to read my take on the clash of the superheroes!

Phil

Both companies have formidable superhero offerings but which one is right for investors? Click here to read my take on the clash of the superheroes!

Phil

Friday, November 22, 2013

Playstation 4 Vs. Xbox One: Does The Launch Really Matter?

With the successful launches of Sony's (SNE) Playstation 4 and Microsoft's (MSFT) Xbox One now behind us, it is a perfect time to consider the effects that initial system releases can have on gaming consoles throughout their lifecycle. Click here to read my take on the new console war!

Phil

Phil

Thursday, November 21, 2013

Meet The Only Airline Stock You'll Need

In my latest article for The Motley Fool, I cover one of my favorite stocks, Alaska Air Group (ALK). From its veritable moat in the Alaskan flight market to its award-winning customer service and top-tier brand image, Alaska Air Group is the only stock an investor needs to consider in the airline industry. Click here to read more!

Phil

Phil

Jim Cramer Was Right: Under Armour Is A Tech Company After All

When I first heard Jim Cramer, host of CNBC's Mad Money, refer to athletic apparel maker Under Armour (UA) as a technology company, I did a double take. After all, the company isn't going to start making smartphones and tablets any time soon.

However, in hindsight it seems Cramer was more right than even he knew himself! Under Armour's recent acquisition of MapMyFtitness, the open fitness-tracking platform, is proof that the sports company has its sights set on bigger things. Click here to find out about the company's next big move!

Phil

Wednesday, November 20, 2013

Can Under Armour Capitalize On Lululemon's Struggles?

Another week, another scandal! Lululemon co-founder Chip Wilson angered his company's legions of fans by stating that he thinks the yoga brand's pants are not fit for every type of woman!

Why should investors care? The reason is simple, American athletic apparel maker Under Armour (UA) is in perfect position to capitalize on Lululemon's latest PR crisis. Management at the Baltimore-based company has been aggressively targeting female athletes to grow its business even more in the coming years. The company plans to expand its female business by 150% in the next four years.

Click here to read why Under Armour will continue to win over female consumers and investors going forward!

Phil

Why should investors care? The reason is simple, American athletic apparel maker Under Armour (UA) is in perfect position to capitalize on Lululemon's latest PR crisis. Management at the Baltimore-based company has been aggressively targeting female athletes to grow its business even more in the coming years. The company plans to expand its female business by 150% in the next four years.

Click here to read why Under Armour will continue to win over female consumers and investors going forward!

Phil

Tuesday, November 19, 2013

Recent Portfolio Changes

I recently updated the 'Current Holdings' page on my blog today. The major changes to my portfolio worth noting are the complete liquidation of Discovery Communications (DISCA), which was sold for approximately 40% profit, and the complete liquidation of Cree (CREE), which was sold for approximately 12% profit.

I have also added considerably to my Chipotle Mexican Grill (CMG) holding, which is now my third largest position behind Under Armour (UA) and MasterCard (MA).

Phil

I have also added considerably to my Chipotle Mexican Grill (CMG) holding, which is now my third largest position behind Under Armour (UA) and MasterCard (MA).

Phil

Proto Labs: A High-Growth Alternative In The 3D Printing Space

In my latest article for The Motley Fool, I write about one of my more lucrative investments in 2013, Proto Labs (PRLB), a small-cap producer of CNC-machined and injection-molded plastic parts.

Often overlooked by investors as just another 3D printing stock, Proto Labs actually has a more stable business than many of the popular printer manufacturers. As such, Proto Labs remains a worthy consideration for any investor seeking long-term, small-cap growth. Click here to read and enjoy!

Phil

Often overlooked by investors as just another 3D printing stock, Proto Labs actually has a more stable business than many of the popular printer manufacturers. As such, Proto Labs remains a worthy consideration for any investor seeking long-term, small-cap growth. Click here to read and enjoy!

Phil

Tesla Is Doing The Electric Slide!

In my latest article for The Motley Fool, I write about Tesla Motors (TSLA), one of the standout stocks in 2013, which has recently come under intense scrutiny as a result of several vehicle fires in its luxurious Model S line. While certainly a serious situation and cause for some concern, the approximate 40% correction in Tesla shares most likely represents a buying opportunity for investors with a long-term mindset. Click here to read and find out why. Enjoy!

Phil

Phil

Monday, November 18, 2013

Chipotle Won't Stop Growing

In recent months, many restaurant companies have made successful IPO's on American exchanges. In the red hot fast casual dining segment, popular companies like Noodles & Company (NDLS) and Potbelly (PBPB) are often considered the next great Chipotle Mexican Grill (CMG).

While a compliment to Chipotle for sure, many analysts and investors searching for the next Chipotle are usually missing a crucial point. Chipotle is not done growing, not by a long shot! Click here to read why I think Chipotle is still the best investment in the fast causal dining space.

Phil

While a compliment to Chipotle for sure, many analysts and investors searching for the next Chipotle are usually missing a crucial point. Chipotle is not done growing, not by a long shot! Click here to read why I think Chipotle is still the best investment in the fast causal dining space.

Phil

Saturday, November 16, 2013

Is Valve's Steam Machine A Viable Competitor To Playstation 4 and Xbox One?

In one of my latest articles for The Motley Fool, I discuss whether or not Valve, maker of the Half-Life and Portal series, has a chance at dethroning Microsoft and Sony in the impending console war. Valve recently announced that it was developing a fully upgradable video game system for 2014. In its various trims, which are to be made by multiple partners, the console will cater to individual gamers' needs. It could in essence be the only console gamers ever need to own! Click here to see if Valve has a chance.

Phil

Phil

Forget Twitter, Buy Square In 2014

Yep, you heard that right. Forget Twitter (TWTR), after it's IPO last week, the stock has already bloated to a massive $25 billion market capitalization and that is far too large for a company that is barely projected to generate over $1 billion in sales next year. The more interesting company is another one of entrepreneur and Twitter co-founder Jack Dorsey's creations, Square.

Square is a payments company that caters to individuals and small businesses that want to accept credit/debit cards on the go and without hassles. In a world that is dominated by ecommerce, mobile devices and electronic payments, Square seems positioned to capitalize on one of the largest trends in the world, digital payments.

The company plans to go public sometime in 2014 and investors would be wise to keep it on their radars. Click here to read why I think Square could be one of 2014's standout IPO's.

Phil

Square is a payments company that caters to individuals and small businesses that want to accept credit/debit cards on the go and without hassles. In a world that is dominated by ecommerce, mobile devices and electronic payments, Square seems positioned to capitalize on one of the largest trends in the world, digital payments.

The company plans to go public sometime in 2014 and investors would be wise to keep it on their radars. Click here to read why I think Square could be one of 2014's standout IPO's.

Phil

Friday, November 15, 2013

Credit Card Giants American Express, MasterCard and Visa Are Teaming Up!

It is no secret that one of my favorite industries to invest in is the payments solutions space. Three of the strongest companies in the segment, American Express (AXP), MasterCard (MA) and Visa (V), are joining forces to establish a new global standard in payments security. The proposed token system would help to eliminate fraud and stands to strengthen the three credit card giants' already formidable positions at the forefront of the payments industry. Click here to read my take on the the big announcement!

Phil

Phil

It's An Exciting Time To Own Disney!

In one my latest articles for The Motley Fool, I analyze the latest earnings report from The Walt Disney Company (DIS). In my opinion, there were three major takeaways from the company's report and several of them seem to indicate that management is intent on bolstering the growth of Disney's two exceedingly popular entertainment properties, Lucasfilm and Marvel Entertainment. Click here to read why there may not be a more exciting time to own shares of Disney than right now!

Phil

Phil

Tuesday, November 12, 2013

Balchem: A Small-Cap Beauty

In my latest article for The Motley Fool, I analyze one of my favorite small-cap growth stocks, Balchem (BCPC), New York-based specialty chemical developer, manufacturer and distributor. While I have written about the company before, shares of BCPC recently hit all time highs only to pull back significantly in the wake of the company's latest earnings report. Now is as good a time as any to consider initiating a long position in the small-cap beauty. Click here to read and enjoy!

Phil

Phil

Monday, November 11, 2013

Rise Of The Left-For-Dead Growth Stocks

In my latest article for The Motley Fool, I discuss a theory I have had for a while, the idea that certain growth stocks trade in tandem with one another. This was never made more clear to me than in 2011, when Netflix (NFLX), Chipotle Mexican Grill (CMG), Monster Beverage (MNST) and Green Mountain Coffee Roasters (GMCR) all rose incredibly alongside one another. However, in the coming years, each stock proceeded to tumble more than 40%, some much more than that!

The pattern was unmistakable and it will happen again, maybe not to these stocks but certainly to others. Accordingly, investors should always monitor stocks that trade as a group because they can often serve as early warning signs of trouble ahead. Click here to read why the the four stocks fell and why they are rising once again!

Phil

The pattern was unmistakable and it will happen again, maybe not to these stocks but certainly to others. Accordingly, investors should always monitor stocks that trade as a group because they can often serve as early warning signs of trouble ahead. Click here to read why the the four stocks fell and why they are rising once again!

Phil

Thursday, November 7, 2013

Starbucks Is A Future Dividend Great

Lost amid the fantastic earnings report by Starbucks Corp. (SBUX) last week was news that the company was raising its dividend substantially. However, this is just one raise in a long line of dividend increases by management over the last four years and it is becoming apparent that Starbucks is a future dividend great. Click here to read why I believe Starbucks should be considered by both growth investors and dividend-growth investors alike!

Phil

Phil

Tuesday, November 5, 2013

Under Armour: Take Advantage Of Post-Earnings Weakness

After reporting a blowout quarter on both top and bottom lines, management at Under Armour , Inc. (UA) proceeded to raise fiscal 2013 guidance. However, shares of UA slid more than 7% in the days after the earnings report, which represents a solid entry point opportunity for investors interested in mid-cap growth. Click here to read why I think UA is a buy at current levels!

Phil

Phil

MasterCard: $1,000 Is Inevitable

In my latest article for The Motley Fool, I discuss why I feel it is only a matter of time before shares of MasterCard Inc. (MA) cross the prestigious $1,000 mark. With industry-leading growth and fundamentals, MasterCard is poised to continue riding the seemingly unstoppable trend among consumers away from cash and check and towards digital forms of payment. Click here to learn more about why I think MasterCard is one of the best investment ideas around!

Phil

Phil

Monday, October 28, 2013

3 Small-Cap Growth Alternatives In The Auto Space

In my latest article for The Motley Fool, I discuss three alternate plays an investor can make when considering the automotive industry. These three companies, one primarily a car dealership, another a vehicle auctioneer and the last a maintenance/repair shop, offer high growth, stable dividends and fair valuation. The best part is that the companies operate outside of most investors' peripheries and carry significantly less headline risk than the major car manufacturers. Click here to read and enjoy!

Phil

Phil

Monday, October 14, 2013

Under Armour: The Athletic Brand Of The Future

In my latest article for The Motley Fool, I write about my best investment ever, Under Armour (UA). I initially purchased shares of UA in 2010 and they have appreciated over 450% since then. It remains far and away the most lucrative investment of my life and the best part is that I see no reason to sell shares even now!

The once niche sports apparel retailer has grown into the dominant athletic apparel brand of current generations in America. Management is now cleverly leveraging the brand's popularity to capture new product categories and geographic markets. With immense brand strength and customer loyalty, Under Armour is positioning to be the only true global competitor to Nike in the long-term! Click here to read and enjoy!

Phil

The once niche sports apparel retailer has grown into the dominant athletic apparel brand of current generations in America. Management is now cleverly leveraging the brand's popularity to capture new product categories and geographic markets. With immense brand strength and customer loyalty, Under Armour is positioning to be the only true global competitor to Nike in the long-term! Click here to read and enjoy!

Phil

Monday, October 7, 2013

My Reason For Writing Finance Articles

Believe it or not, the main reason I write finance articles for Seeking Alpha and The Motley Fool is to help formulate my own investing ideas. I find that some of my best ideas with regard to finance come from doing the research that is required to write an article designed to help other investors!

Of course, this is a mutually beneficial exercise as I only research stocks that I feel are worthy of extra consideration from investors in general. As I, hopefully, teach readers about a stock I am also very much teaching myself about the same stock. Some of my best investing ideas have come from writing articles, including Discovery Communications Inc. (DISCA) at ~$60 and Boston Beer Co. Inc. (SAM) at ~$150.

My main goal with investing is to make money, and avoid losing it, in the long-term. So, for as long as I write finance articles, be assured that I always have readers' best interests at heart, because often times the readers' interests are the very same as my own!

Phil

Update To 'Current Holdings'

Since I have neglected to update the 'Current Holdings' page of my blog for over a month, I have made a point to do so today! I made some small position changes, namely selling all of the WETF, PRLB and TSLA positions for profit to go into CREE, FLT and SAM. Also, my UA position has become my largest position by dollar amount, overtaking MA in recent months due to signifiant outperformance.

Stocks of interest to me now are Noodles & Company (NDLS) and Potbelly Corporation (PBPB), both of which operate in the fast/casual dining segment and only recently IPO'd. The segment is seeing increasing interest from investors in recent months and this bodes well for most of the names in the space, in my opinion. I will look to initiate a position in one or both of these names going forward.

Phil

Stocks of interest to me now are Noodles & Company (NDLS) and Potbelly Corporation (PBPB), both of which operate in the fast/casual dining segment and only recently IPO'd. The segment is seeing increasing interest from investors in recent months and this bodes well for most of the names in the space, in my opinion. I will look to initiate a position in one or both of these names going forward.

Phil

Saturday, October 5, 2013

Noodles & Co: The Next Big Thing In Casual Dining?

In my latest article for The Motley Fool, I research Noodles & Co, a rising star in America's very popular fast-casual dining segment. Drawing comparisons to already immensely successful chains like Chipotle Mexican Grill, Inc. (CMG) and Panera Bread Company (PNRA), my analysis indicates that Noodles & Co has what it takes to expand across The United States at a blistering pace, namely a simple yet novel menu and an already proven management team. Click here to read and enjoy!

Phil

Phil

Tuesday, October 1, 2013

eBay: A Viable Competitor To MasterCard And Visa?

In my latest article for The Motley Fool, I discuss a stock that has intrigued me in recent months, eBay Inc (EBAY). As much as the company is known for its namesake auction site, eBay has become a dominant player in payments solutions with its 'Payments' division, which includes PayPal and related services. On the heels of rapid growth in the segment and with over 132 million active accounts, the question investors must ask is, "Can PayPal challenge credit card giants MasterCard Incorporated (MA) and Visa Inc. (V) on a global scale going forward?" Click here to read and find out! Enjoy!

Phil

Phil

Monday, September 30, 2013

My eBook Is On Sale For A Limited Time, $0.99 on Amazon Kindle!

My eBook Growth Investing: Finding The Perfect Stock For You, available on all Amazon Kindle devices and apps, is now on sale for $0.99 but only for a limited time! You can still borrow it for free through Amazon's Prime service.

If you enjoy my investing approach and are at all interested in how I pick my long-term equity investments, now is the perfect time time buy or borrow a digital copy of my eBook, which was designed with the novice investor in mind. In the book, I provide step-by-step strategies to finding successful long-term growth investments that are specifically tailored to each individual investor's own comfort level.

Some of the stocks that are mentioned in the book, including Under Armour Inc. (UA) and Starbucks Corporation (SBUX), I still hold today. I explain my thought process behind my decision to initially purchase each one as well as the work I put into monitoring each one on a weekly basis.

I hope everyone enjoys the book and most importantly, I hope everyone invests with care and success! Have fun,

Phil

Disclaimer: The contributors to this blog are not professional advisors. All ideas written and shared here, or in any subsequently mentioned eBooks and articles, are strictly the opinions of the authors and should not be used to make investing decisions. Always consult a professional advisor before investing.

Tuesday, September 24, 2013

Take-Two: Grand Theft At Its Current Valuation

In my latest article for The Motley Fool, I write about Take-Two Interactive Software (TTWO), the small-cap video game publisher responsible for blockbuster series like Grand Theft Auto, Max Payne and BioShock, among many others. On the heels of the most successful entertainment product launch in history that was Grand Theft Auto 5, the company is generating astounding revenue that belies the stock's modest valuation. As such, Take-Two seems poised to gain further momentum as a result of the impending next-generation of gaming consoles. Click here to read the article.

Phil

Friday, September 20, 2013

Disney: The Undisputed King Of Content

In my latest article for The Motley Fool, I analyze none other than The Walt Disney Company (DIS). Although the company is still perhaps best known for its storybook characters and sprawling recreational parks, Disney has shifted its business model in recent years to become more of a traditional media company. With acquisitions like ABC and ESPN, Pixar, Marvel and Lucasfilm, Disney has built the most impressive stable of entertainments brands in the business. As such, the media conglomerate remains in perfect position to capitalize on the constant and growing demand for original, compelling content. Click here to read why I think shares of DIS are headed higher!

Phil

Phil

Tuesday, September 17, 2013

Will The Walking Dead Spin-off Boost AMC Networks Further?

Monday, September 16, 2013

New Blog Page For Motley Fool Articles

I have included a separate page for all of my articles published exclusively for The Motley Fool. It can be found on the far right portion of the blog, under the link for Seeking Alpha articles. Read and enjoy, as I have several more articles in the works.

Phil

Phil

My Second Article On The Motley Fool! AMC Networks: Breaking Good

In my second article for The Motley Fool, I stay in the media segment and analyze the growth prospects of cable television leader AMC Networks Inc. (AMCX), the small-cap company behind the incredibly popular drama series The Walking Dead. The company remains on a path towards growth despite several of its hit shows scheduled to wind down, including Breaking Bad (which ends in a month) and Mad Men (set for its final season in 2014). Click here to read and enjoy!

Phil

Phil

Sunday, September 15, 2013

I Am Now Writing For The Motley Fool! Here's My First Article!

In addition to being a Seeking Alpha contributor, I am now a freelance contributor to The Motley Fool. My first article for The Fool is on one of my favorite stocks, Discovery Communications Inc. (DISCA), a large-cap media company with room to grow thanks to its unique programming content and relative lack of direct competitors. Anyone that follows my stock ideas knows that I am a big believer in the media companies that are primarily engaged in content-creation, as there is now a constant demand for new and compelling content thanks to recent technology innovations which allow viewers to consume vast amounts of programming like never before. Click here to read and enjoy!

Phil

Phil

Saturday, September 14, 2013

Has The Low Winter Sun Begun To Set On AMC Networks?

For those who don't already know, Low Winter Sun is the latest drama series on AMC. However, it has been met with lukewarm results from both critics and viewers alike and highlights an ongoing and very serious problem for management at AMC Networks and for investors in AMCX, a recent inability to generate new and compelling content that is on par with the company's popular but soon-to-be ending favorites Breaking Bad and Mad Men.

In my latest Seeking Alpha-exclusive Small-Cap Insight article, I try to determine whether the company's recent struggles with creating new content is simply a short-term problem or one that will hang over shares of AMCX for the foreseeable future. Click here to read and enjoy!

Phil

In my latest Seeking Alpha-exclusive Small-Cap Insight article, I try to determine whether the company's recent struggles with creating new content is simply a short-term problem or one that will hang over shares of AMCX for the foreseeable future. Click here to read and enjoy!

Phil

Sunday, September 8, 2013

KAR Auction Services: A Small-Cap Worth Bidding On

In my latest Seeking Alpha exclusive article, I analyze KAR Auction Services, Inc. (KAR), a small-cap company engaged in the auction selling of automobiles in North America. As a relatively low-key way to benefit on several emerging trends in the automotive landscape, including rising new and used car sales, the increasing average age of American cars and trucks and expected growth in whole auction volumes, KAR appears poised for future growth and is worthy of a bid from investors seeking long-term, small-cap growth. Click here to read and enjoy!

Phil

Phil

Thursday, August 29, 2013

Monro: Braking Good

In my newest Small-Cap Insight article on Seeking Alpha, I analyze a company in the automotive repair and tire service industry, Monro Muffler Brake Inc. (MNRO). While the company operates very much under the radar of most investors compared to the major automotive industry favorites such as Tesla Motors Inc. (TSLA) and Ford Motor Co. (F), it remains a viable business segment with tremendous upside potential. Click here to read and enjoy!

Phil

Phil

Monday, August 26, 2013

On The Hunt For Profits With Cabela's

In my latest Seeking Alpha exclusive Small-Cap Insight article, I analyze the hunting/outdoor sports retailer Cabela's Incorporated (CAB). The small-cap, niche retailer has a powerful advantage compared to more traditional sporting goods retailers because the company markets specific, high-demand products to select, high-value consumers. As long as the trend of accelerating firearms purchases continues in The United States, Cabela's looks poised to keep growing and rewarding long-term shareholders. Click here to read and enjoy!

Phil

Phil

Monday, August 19, 2013

Snyder's-Lance: A Small-Cap Worth Snacking On

In my latest Seeking Alpha exclusive article, I analyze small-cap stock Snyder's-Lance, Inc. (LNCE), owner of snack food brands such as Snyder's of Hanover, Lance and Cape Cod. The company recently reported second quarter earnings results that came in below analyst expectations and the stock proceeded to sell off over 15% in the following two weeks. At current levels, shares of the oversold LNCE appear attractive in the long-term. As a Small-Cap Insight piece, the article will only be available to the public for 30 days! Click here to read and enjoy!

Phil

Phil

Monday, August 12, 2013

Tracking My Seeking Alpha Performance

As it is often mentioned on the Seeking Alpha contributor forums but has yet to be implemented, I thought it would be interesting to track my own performance on the site. Since I usually avoid giving very specific buy advice in my articles, I will simply limit the performance-tracking to stocks that I wrote favorably about. I will only include stocks that have been written about more than two months ago, to provide better perspective. I will include the company name and ticker as well as the date the article was published and the stock's approximate price per share at the time of publication and subsequent gain/loss.

(All numbers includes dividends reinvested where applicable)

Positive Mentions:

Discovery Communications, Inc. (DISCA) - 1/01/13 - $63.48, 26.45% gain

Scripps Network Interactive, Inc. (SNI) - 1/17/13 - $58.90, 28.55% gain

Alaska Air Group, Inc. (ALK) - 1/23/13 - $46.65, 29.18% gain

Church & Dwight Company Inc. (CHD) 1/29/13 - $57.60, 8.04% gain

VF Corporation (VFC) - 2/05/13 - $148.74, 34.81% gain

W.W. Grainger, Inc. (GWW) - 2/07/13 - $215.86, 20.78% gain

MasterCard Incorporated (MA) - 2/12/13 - $519.64, 22.37% gain

Visa Inc. (V) - 2/12/13 -$156.80, 14.89% gain

Nike Inc. - 2/26/13 - 2/26/13 - $54.27, 23.14% gain

J&J Snack Foods Corp. (JJSF) - 3/13/13 - $72.05, 10.43% gain

The Hershey Company (HSY) - 3/19/13 - $85.45, 13.67% gain

Balchem Corp. (BCPC) - 4/10/13 - $43.72, 20.11% gain

eBay Inc. (EBAY) - 4/22/13 - $51.63, 3.35% gain

Stepan Company (SCL) - 5/01/13 - $53.20, 10.64% gain

Boston Beer Co. Inc. (SAM) - 5/14/13 - $150.27, 40.89% gain

The Fresh Market, Inc. (TFM) - 6/03/13 - $49.60, 13.79% gain

(All numbers includes dividends reinvested where applicable)

Positive Mentions:

Discovery Communications, Inc. (DISCA) - 1/01/13 - $63.48, 26.45% gain

Scripps Network Interactive, Inc. (SNI) - 1/17/13 - $58.90, 28.55% gain

Alaska Air Group, Inc. (ALK) - 1/23/13 - $46.65, 29.18% gain

Church & Dwight Company Inc. (CHD) 1/29/13 - $57.60, 8.04% gain

VF Corporation (VFC) - 2/05/13 - $148.74, 34.81% gain

W.W. Grainger, Inc. (GWW) - 2/07/13 - $215.86, 20.78% gain

MasterCard Incorporated (MA) - 2/12/13 - $519.64, 22.37% gain

Visa Inc. (V) - 2/12/13 -$156.80, 14.89% gain

Nike Inc. - 2/26/13 - 2/26/13 - $54.27, 23.14% gain

J&J Snack Foods Corp. (JJSF) - 3/13/13 - $72.05, 10.43% gain

The Hershey Company (HSY) - 3/19/13 - $85.45, 13.67% gain

Balchem Corp. (BCPC) - 4/10/13 - $43.72, 20.11% gain

eBay Inc. (EBAY) - 4/22/13 - $51.63, 3.35% gain

Stepan Company (SCL) - 5/01/13 - $53.20, 10.64% gain

Boston Beer Co. Inc. (SAM) - 5/14/13 - $150.27, 40.89% gain

The Fresh Market, Inc. (TFM) - 6/03/13 - $49.60, 13.79% gain

Despite Some Turbulence, Alaska Air Group Is Still Headed North

In a 'Small-Cap Insight' follow-up to my first article on Alaska Air Group, Inc. (ALK) written earlier in the year, I discuss the recent setbacks the company has been dealing with and that have pressured shares in the last few months, including a pair of only recently resolved labor disputes and an increase in competition in its signature Alaska market by discount airliner JetBlue Airways Corporation (JBLU). While serious, these problems do not make ALK any less of an attractive long-term investment as I remain confident that management's plans to defend its turf are viable. The stock is still the only equity to consider in the space as it leads all others with regard to fundamentals. Click here to read more!

Phil

Phil

Saturday, August 10, 2013

Proto Labs: Breaking The Mold

In my latest Seeking Alpha exclusive article, I tackle one of the best trading stocks in the market today, Proto Labs, Inc. The small-cap company is a machining producer that creates molds from 3D CAD models supplied by its developer-based customers. Often confused with 3D printing stocks like 3D Systems Corporation (DDD) and ExOne Co. (XONE), Proto Labs actually runs a more stable business and offers relative growth to most of the major 3D printing companies. Click here to read the article, which will be available to the public for only 30 days!

Phil

Friday, August 9, 2013

New Seeking Alpha Article On Francesca's Holdings, Chosen As Editors' Pick

My newest article on Seeking Alpha was published today and was chosen as an Editors' Pick. The article focuses on small-cap specialty retailer Francesca's Holdings Corp. (FRAN), which has been underperforming the broader market recently. However, with robust growth projections, compelling valuation and a viable growth story, shares of FRAN look attractive at current levels. Click here to read and enjoy!

Phil

Phil

Tuesday, August 6, 2013

Lithia Motors: Dealing Cars To Consumers, Profits To Investors

Hey all, check out my latest Seeking Alpha exclusive article on Lithia Motors Inc. (LAD), an owner and franchisor of car dealerships in the Western and Mid-Western United States. The small-cap company has performed exceedingly well for investors over the last few years, outperforming even the seemingly unstoppable Tesla Motors, Inc. (TSLA). As a Small-Cap Insight, the article will be available to the public for 30 days only!Click here to read and enjoy!

Phil

Phil

Sunday, August 4, 2013

Change In Positions for August 2013

I recently sold all of my shares of eBay Inc. (EBAY) at a 7.5% gain and used the proceeds to add to my Visa Inc. (V) holding, as the latter dropped approximately 10% on news regarding increased regulation of swipe fees. I also purchased more shares of Under Armour, Inc. (UA), as the stock pulled back a little after a massive surge in price due to an earnings beat and increased guidance for fiscal 2013. UA continues to be one of the largest positions in my portfolio and my most profitable stock ever. I also sold all remaining shares of Alaska Air Group, Inc. (ALK) at 110% gain, McCormick & Company, Incorporated (MKC) at 16% gain and Google Inc. (GOOG) at 5% gain. I used the proceeds to initiate new positions in WisdomTree Investments, Inc. (WETF) at the $11 level and Tesla Motors, Inc. (TSLA) at the $120 level.

Phil

Phil

Domino's: Delivering Pizza and Gains!

In my latest Seeking Alpha exclusive article, I focus on Domino's Pizza, Inc. (DPZ), a small-cap company that has provided increasingly large returns for investors over the years, the stock is up 800% in the last decade alone! With aggressive international expansion plans and a successful embracement of technology, the pizza-delivery specialist looks set to continue rewarding long-term investors in the future. Please remember, as a Small-Cap Insight piece, the article will only be available to the public for 30 days! Click here to read and enjoy

Phil

Phil

Wednesday, July 31, 2013

Five Below: Far Above

Check out my latest Small-Cap Insight article on Seeking Alpha about Five Below, Inc. The company is an owner and operator of discount retail stores in The United States, selling an array of products under $5.00 targeted towards teens and pre-teens. With plans to expand the company's store count almost eightfold in the future, management seems to have a viable growth plan that can reward investors in the long-term. Click here to read the article, which is available only to the public for 30 days!

Phil

Tuesday, July 23, 2013

Bloomin' Brands: Fully Bloomed At Current Levels

In my most recent Seeking Alpha exclusive article I focus on Bloomin' Brands, Inc. (BLMN), an owner and operator of casual dining restaurants in domestic and international markets. The company's brands include Outback Steakhouse and Roy's among several others. While the long-term growth story appears intact and viable, in the short-term the stock is overextended and expensive when compared to peers and as such warrants caution. The article was chosen as a Small-Cap Insight article and will be available to the public for only 30 days! Click here to read and enjoy!

Phil

Phil

Tuesday, July 16, 2013

Prestige Brands: Small Company, Big Brand Potential

Sunday, July 14, 2013

Buffalo Wild Wings: Ahead Of The Herd

Monday, July 1, 2013

Krispy Kreme Doughnuts: 'Krispy' Growth, 'Kremey' Returns

As a follow-up to my recent article on Dunkin' Brands Group, the company behind Dunkin' Donuts and Baskin-Robbins, I researched and analyzed another small-cap restaurant stock, Krispy Kreme Doughnuts, Inc. (KKD) and the results were most impressive! Click here to read my newest Seeking Alpha exclusive article and find out why shares of Krispy Kreme Doughnuts would make a deliciously sweet addition to most long-term growth portfolios.

Phil

Phil

Thursday, June 27, 2013

Portfolios Can Still Run On Dunkin'

Hey everyone, check out my second article this week on Dunkin' Brands Group, Inc. (DNKN), the company behind the two popular fast food chains Dunkin' Donuts and Basin-Robbins. While directly competing with much bigger companies like Starbucks Corporation (SBUX) and McDonald's Corp. (MCD), Dunkin' Brands still remains a relatively small company and as such offers nice growth potential. The article is an Editors' Pick and a Small-Cap Insight, which means it will only be available to the public for 30 days! Click here to read and enjoy!

Phil

Phil

Monday, June 24, 2013

Carter's Inc. Makes Kid-Sized Clothes But Offers Adult-Sized Returns!

Check out my newest Seeking Alpha exclusive article on Carter's Incorporated, a relatively small but well established designer/manufacturer of clothing for babies and small children. The stock has managed to stay very strong in the most recent market correction and warrants a closer look by the majority of long-term growth investors. The article was chosen as Editors' Pick and Small-Cap Insight, which means it will be available to the public for only 30 days! Click here to read and enjoy!

Phil

Phil

Tuesday, June 18, 2013

Packaging Corporation: Boxed And Ready To Ship Profits

Check out my latest Seeking Alpha exclusive article on a relatively unknown company, Packaging Corp. of America (PKG), the fifth largest manufacturer of corrugated boxes in North America. The article was chosen as Editor's Pick and Small Cap Insight, which means it will be available to the public for only 30 days! Click here to read and enjoy!

Phil

Phil

Wednesday, June 12, 2013

Sony To Microsoft, Game Over?

Check out my latest Seeking Alpha exclusive article on the impending video game console war between Sony Corporation (SNE)'s Playstation 4 and Microsoft Corporation (MSFT)'s Xbox One. The article summarizes both companies' recent E3 press events, discusses the major takeaways from the developer's conference and predicts some of the fallout that is likely to occur over the next generation in gaming. Click here to read and enjoy!

Phil

Phil

New Positions

I added several new positions on recent market weakness. The largest position I initiated was Google Inc. (GOOG), followed by Chipotle Mexican Grill, Inc. (CMG), then Balchem Corp. (BCPC) and FleetCor Technologies, Inc. (FLT). I will update the 'Current Holdings' section accordingly.

Phil

Phil

Monday, June 3, 2013

The Fresh Market: Put It On Your Grocery List

Check out my latest Seeking Alpha exclusive article on The Fresh Market, a high-end specialty grocery retailer that is rapidly expanding across The United States. The article was chosen as a Small-Cap Insight and an Editor's Pick, which means it will only be available to the public for 30 days! Click here to read and enjoy!

Phil

Phil

Thursday, May 23, 2013

Microsoft: It's Time To Put Your Game Face On!

Tuesday, May 14, 2013

Boston Beer: Almost Time To Take A Sip

My latest article on Seeking Alpha is an Editor's Pick and focuses on Boston Beer Company (SAM), which is responsible for popular alcoholic brands like Samuel Adams, Twisted Tea and Angry Orchard. After a recent earnings miss the stock dropped significantly and now presents investors with fair valuation. Read the article here to see why I believe shares of SAM will continue to stay buzzed for the long-term and why I plan to initiate a position in the stock soon.

Phil

Phil

Friday, May 10, 2013

Content-Creation And Payments: 2 Growth Trends Driving My Portfolio Forward

Check out my latest Seeking Alpha article, in which I cover the two major growth trends that have been driving my portfolio's outperformance: media content-creation and payment-solutions. It is my belief that investors attuned to overall trends in the equity markets are better prepared to anticipate future growth. Click here to read why I think the two dominant trends in my portfolio are set to continue for years to come!

Phil

Phil

Saturday, May 4, 2013

The Five Greatest Stocks Update For May 2013

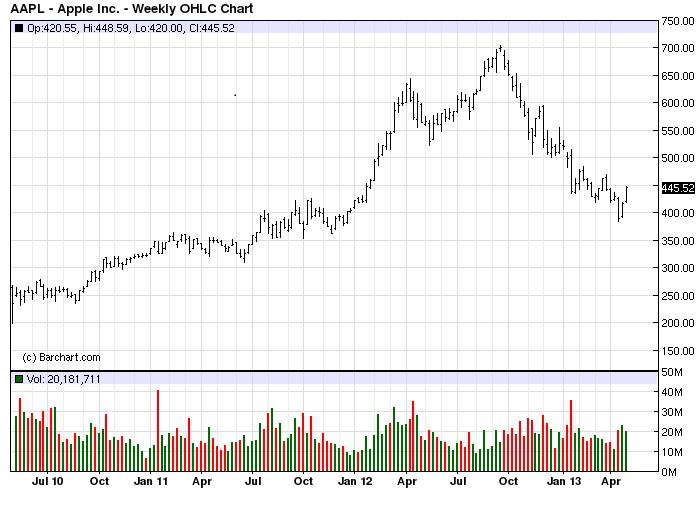

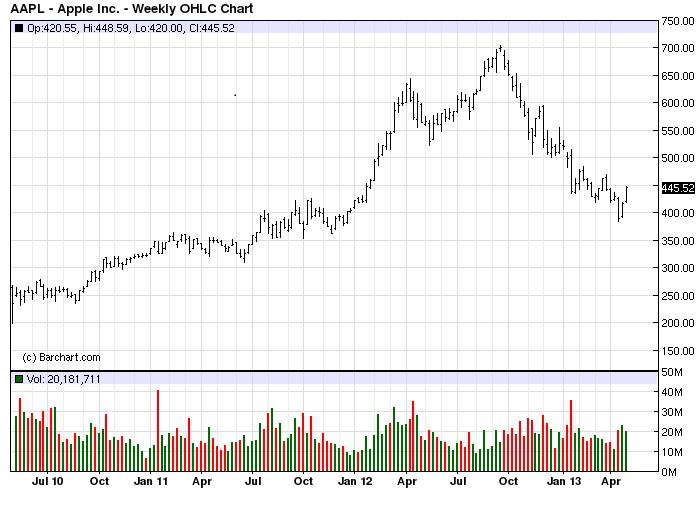

When I originally wrote my post on The Five Greatest Stocks For The Next Five Years back in October of 2011, I really thought that these five great stocks would basically trounce the S&P 500 by now, but something certainly did change with one of the five greats named Apple Inc. (AAPL). At the time of the original post Apple was trading just over $400 per share and went on to rally to just over $700 per share by the middle of September of 2012 and then preceded to crash all the way under $400 in April of this year. I have attached a chart below to show what happened:

Chart courtesy of Barchart.com

Because of this correction in Apple, I now became convinced that the portfolio would now be on the losing end of things, but low and behold that would not be the case. So here are the results going into May 6th, 2013:

Portfolio Total Return With Dividends Reinvested: 34.6%

S&P 500 (SPY) With Dividends Reinvested: 32.9%

MasterCard (MA): Price: $553.55, Total Return of 60.1%

Under Armour (UA): Price: $57.71, Total Return of 36.7%

Google (GOOG): Price: $845.72, Total Return of 42.7%

Apple (AAPL): Price: $449.98, Total Return of 12.8%

Amazon (AMZN): Price: $258.05, Total Return of 20.9%

Stats courtesy of Low-Risk Investing

So there you have it, the Five Greats managed to continue to beat the S&P 500. Going forward. I think that the correction in Apple is probably done, but it now may be a company that is no longer in its growth phase, this is a bit concerning and something that I did not see coming this fast, but on a good note the company is committed to increasing their dividends as well as buybacks, this should allow the stock to at the least match the performance of the S&P 500. Once again, even after some corrections, I am still convinced that for the next 3+ years this portfolio should outperform the S&P 500.

Disclaimer: All articles are written as an opinion of the writer or writers. The contributors on this website are not professional investment advisors. These articles are written to share investing ideas that may be of interest to the reader. Always seek the advice of a professional investment advisor before investing.

Disclosure: I am long GOOG, UA, MA.

Chart courtesy of Barchart.com

Because of this correction in Apple, I now became convinced that the portfolio would now be on the losing end of things, but low and behold that would not be the case. So here are the results going into May 6th, 2013:

Portfolio Total Return With Dividends Reinvested: 34.6%

S&P 500 (SPY) With Dividends Reinvested: 32.9%

MasterCard (MA): Price: $553.55, Total Return of 60.1%

Under Armour (UA): Price: $57.71, Total Return of 36.7%

Google (GOOG): Price: $845.72, Total Return of 42.7%

Apple (AAPL): Price: $449.98, Total Return of 12.8%

Amazon (AMZN): Price: $258.05, Total Return of 20.9%

Stats courtesy of Low-Risk Investing

So there you have it, the Five Greats managed to continue to beat the S&P 500. Going forward. I think that the correction in Apple is probably done, but it now may be a company that is no longer in its growth phase, this is a bit concerning and something that I did not see coming this fast, but on a good note the company is committed to increasing their dividends as well as buybacks, this should allow the stock to at the least match the performance of the S&P 500. Once again, even after some corrections, I am still convinced that for the next 3+ years this portfolio should outperform the S&P 500.

Disclaimer: All articles are written as an opinion of the writer or writers. The contributors on this website are not professional investment advisors. These articles are written to share investing ideas that may be of interest to the reader. Always seek the advice of a professional investment advisor before investing.

Disclosure: I am long GOOG, UA, MA.

Wednesday, May 1, 2013

Step Up Your Dividend Growth With Stepan Co.

My latest Seeking Alpha exclusive article is on Stepan Co, a basic and intermediate chemical manufacturer. The company announced disappointing earnings results earlier in the week and I believe the recent weakness presents long-term investors with a nice opportunity to buy shares of this dividend champion. Click here to read.

Phil

Phil

Wednesday, April 24, 2013

Adding To eBay Position

As I stated in my latest article, I think the recent drop in shares of eBay Inc. (EBAY) presents a great opportunity to purchase the stock at good valuation levels. I added significantly to my position yesterday and plan to add more in the coming weeks. If I achieve the pricing I want for entry, eBay could very well become my second largest holding by the end of the month.

Phil

Phil

Monday, April 22, 2013

eBay: A Compelling Buy On Recent Weakness

Wednesday, April 10, 2013

Balchem: Boring But Beautiful

Click here to read my newest Seeking Alpha exclusive article on Balchem Corporation (BCPC), a specialty chemical developer/manufacturer that has appreciated over 1,000% in the last decade alone!

Phil

Phil

Saturday, April 6, 2013

My Portfolio Performance Through Quarter 1 2013

- MasterCard Inc. (MA) + 8.21%

- Under Armour Inc. (UA) + 9.29%

- eBay Inc. (EBAY) + 8.87%

- The Walt Disney Company (DIS) + 15.89%

- Discovery Communications Inc. (DISCA) + 23.76%

- Visa Inc. (V) + 8.96%

- Alaska Air Group Inc. (ALK) + 37.78%

- Starbucks Corporation (SBUX) + 7.78%

- Time Warner Inc. (TWX) + 21.02%

- McCormick & Company, Inc. (MKC) + 11.6%

- Under Armour Inc. (UA) + 9.29%

- eBay Inc. (EBAY) + 8.87%

- The Walt Disney Company (DIS) + 15.89%

- Discovery Communications Inc. (DISCA) + 23.76%

- Visa Inc. (V) + 8.96%

- Alaska Air Group Inc. (ALK) + 37.78%

- Starbucks Corporation (SBUX) + 7.78%

- Time Warner Inc. (TWX) + 21.02%

- McCormick & Company, Inc. (MKC) + 11.6%

Note: Dividends are not included. The above list is all of the stocks that I own currently. The only stock on the list that I have not owned since January 1, 2013 is Time Warner Inc. (TWX). Apple Inc. (AAPL) and CF Industries Holdings Inc. (CF) are not included as I have exited the positions completely. Their performances YTD are as follows:

Apple Inc. (AAPL) - 20.48%

CF Industries Holdings Inc. (CF) - 6.49%

Phil

Changes To My Portfolio In March

I completely exited my Apple position over the last few weeks, I no longer like the growth prospects of the company as much as those of some other companies that I have wanted to add to/initiate positions in for a while. I used the proceeds to add to The Walt Disney Company (DIS) core holding in my IRA as well as start a position in Time Warner Inc. (TWX).

I also increased my Under Armour position on weakness and sold my remaining shares of CF Industries Holdings Inc. (CF) at a slight loss. I plan to revisit CF at some point but all indications are for little to zero growth in 2013/2014 so there are better alternatives at this point in time, that's my thinking anyway.

My Alaska Air Group (ALK) holding has nearly doubled over the last year and takes up a much more significant part of my portfolio than I would have ever expected. I have not sold any as of this time and I really don't have plans to yet, the stock is still very cheap and has more room to run in my opinion.

Phil

I also increased my Under Armour position on weakness and sold my remaining shares of CF Industries Holdings Inc. (CF) at a slight loss. I plan to revisit CF at some point but all indications are for little to zero growth in 2013/2014 so there are better alternatives at this point in time, that's my thinking anyway.

My Alaska Air Group (ALK) holding has nearly doubled over the last year and takes up a much more significant part of my portfolio than I would have ever expected. I have not sold any as of this time and I really don't have plans to yet, the stock is still very cheap and has more room to run in my opinion.

Phil

Monday, March 25, 2013

Game Over for GameStop Inc?

Tuesday, March 19, 2013

Hershey Is Pretty Sweet

Wednesday, March 13, 2013

Snack On Some Dividends With J&J Snack Foods

Check out my latest Seeking Alpha article on the tiny food/beverage company with big upside potential, J&J Snack Foods. Offering solid growth and robust dividend-growth, J&J Snack Foods is a nice, conservatively run company that should continue to offer long-term investors serious returns.

Phil

Tuesday, March 5, 2013

Do You Like The Walking Dead?

Wednesday, February 27, 2013

New Seeking Alpha Article On Nike

Sunday, February 24, 2013

Shifted Some Positions

I recently reduced my position in CF Industries Holdings Inc. (CF) and added to Discovery Communications Inc.(DISCA) and eBay Inc. (EBAY). I have adjusted the 'Current Holdings' page to reflect the changes and order of position size.

Phil

Phil

Tuesday, February 19, 2013

New Article: Cummins Inc.

Check out my latest article on Cummins Inc, designer and manufacturer of diesel and natural gas engines around the world. What was once a great growth story is now a great dividend-growth story with possible future growth-acceleration on the horizon.

Phil

Phil

Tuesday, February 12, 2013

MasterCard: The Master Stock

Monday, February 11, 2013

Update to Current Holdings

As I posted on Seeking Alpha today, I have added another stock to my portfolio, McCormick & Company, Incorporated (MKC). I like the current valuation after the stock sold off due to an earnings miss. I also stepped back into some Apple Inc. (AAPL) shares late last week. Additionally, I added Alaska Air Group (ALK) to my portfolio as well. I will update the 'Current Holdings' page on the blog to reflect these changes.

Phil

Phil

Thursday, February 7, 2013

My New Article on W.W. Grainger!

Click here to read my latest Seeking Alpha article on W.W. Grainger, an excellent dividend-growth prospect!

Phil

Phil

Tuesday, February 5, 2013

My Latest Seeking Alpha Article Is Out!

Tuesday, January 29, 2013

Church and Dwight: A Solid Investment In Growth and Dividends

Wednesday, January 23, 2013

Alaska Air Group Can Elevate Your Portfolio!

Find out why, click here to view my latest Seeking Alpha article on the Alaska Air Group and the rest of the airline industry!

Philip

Philip

Thursday, January 17, 2013

Discovery Communications Vs. Scripps Networks Interactive

Check out my new article on Seeking Alpha, it compares the two best pure content-creation companies out there.

Wednesday, January 2, 2013

New Seeking Alpha Article!

My second article on Seeking Alpha was just published about an hour ago. The article is on one of my favorite stocks, Discovery Communications, the company responsible for Discovery Channel, The Learning Channel, Science Channel, Military Channel and more! Check it out and leave feedback if you want!

View it here!

Philip

View it here!

Philip

Subscribe to:

Posts (Atom)